Re:Staking Weekly #1

Restaked AI Agents, Unique Slashable Stake, and Rewards Distribution

GM friends 👋!

Welcome to the inaugural issue of the Re:Staking Weekly!

It's an interesting time for restaking — services begin their quest to generate yield, while incremental advancements in protocol design, such as slashing, are still on the horizon. We are still early.

This newsletter is a place to recognize the efforts that push our space forward and distill a sense of optimism.

Every other Friday, we'll bring you the most significant developments in the restaking ecosystem in a 5-minute read. We'll cover yield-generating Actively Validated Services (AVS), operators securing our networks, mechanism research, and a lot more.

It will be a lot of fun, so buckle up and enjoy the ride!

Restaked AI Agents

Gaia, a decentralized AI agent network, is integrating restaking. I'm stoked about this.

According to the announcement, the planned integration will first begin with a checker/watchtower AVS monitoring the underlying inference network, and then gradually transition into a full-fledged AI agent service network.

What makes this particularly fascinating is how AI agents expose the limitations of current staking models. Different AI agents need different security guarantees. For example, some agents will handle high-value automated fund transfers, while others will only process routine inferences. Grouping them under one network with uniform staking requirements ignores these crucial security differences.

Restaking could solve this through customized quorum and operator setups. This creates a dynamic market where security requirements and node capabilities naturally align with business needs, letting each agent or agent network find its optimal security-to-cost ratio.

Hot off the Block

New Insights into EigenLayer's Updated Security Model

It's been a few weeks, but the revamped security model, which introduces unique stake1 that prevents cascading slashing and other side effects, is worth more discussion.

Specifically, it's worth noting that unique (slashable) stake and non-slashable stake are not mutually exclusive. In fact, they can be used in different services for different scenarios.

Ismael (Lagrange Labs) explains the purpose non-slashable stake plays in AVS security design.

Sreeram and Ethan's X thread on why you would need both slashable and non-slashable stake.

LRT Liquidity

Liquid Restaking Tokens (LRTs) currently dominate supply-side TVL, providing the core economic security for many AVS services.

Kairos Research's latest data shows that LRTs are entering a pivotal phase. As TVL becomes relatively stable post-rewards feature rollout, LRTs (specifically Renzo, Puffer, and Kelp DAO) will compete by optimizing AVS selection strategies, rewards compounding, and direct protocol incentives.

Restaking in Numbers

Although there has been a gradual outflow of TVL from the EigenLayer ecosystem, which still holds a substantial 10.8 billion, the number of AVS has continued to grow, with 3 new services recently joining the ecosystem. However, we still need a lot more services to start generating revenue and rewards.

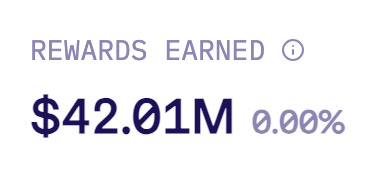

Speaking of rewards, total of $42M of rewards are being earned by the operators and restakers. That’s huge! We need more numbers like this.

The deployment ratio—the percentage of assets actually put to work—has also increased by 8.7%, indicating that the ecosystem is operating quite efficiently. However, we still have significant room for improvement when it comes to the restaking ratio, the amount of total circulating ETH is in restaking.

News Bites

Rewards

P2P.org Operator Delegation Rewards: P2P.org is distributing 828.2 ETH to its delegated restakers.

EigenLayer Programmatic Incentives: In case you missed it, EigenLayer's programmatic incentive is still ongoing. If you are an operator registered with at least 1 AVS or a restaker who has delegated your stake to an operator with at least 1 AVS registration, you are eligible.

New AVS

K3 Labs: Event based middleware and trigger network.

Chainbase: on-chain data processing network.

Skate Chain: L2 designed for interoperability, combining intent execution and preconfirmation.

New Ecosystem Tooling

OpenBlock Dashboard: New dashboard for AVS rewards, stake distribution, and ecosystem health.

Eigen Economy: Essential economic metrics for the EigenLayer ecosystem.

Food for Thought

I've been pondering whether restaking serves primarily as a tool for bootstrapping services (largely for marketing purposes) or for bootstrapping security. These two functions represent vastly different utilities and merit closer scrutiny.

The current landscape suggests that most services use restaking to bootstrap their networks, while security bootstrapping remains largely trivial. However, will this landscape shift in the future? As a thought experiment, imagine a relatively mature project leveraging restaking to bootstrap security. Would Solana, for instance, use ETH or BTC for security? I suspect not.

That’s it for this week’s Re:Staking newsletter. We will see you in 2 weeks!

Thanks for reading,

Thanks to Alex and Ethan for the edits.

The amount of ETH an operator commits to an AVS’s Operator Set, which can be slashed only by that set if the operator fails to perform tasks correctly.