Re:Staking Weekly #6

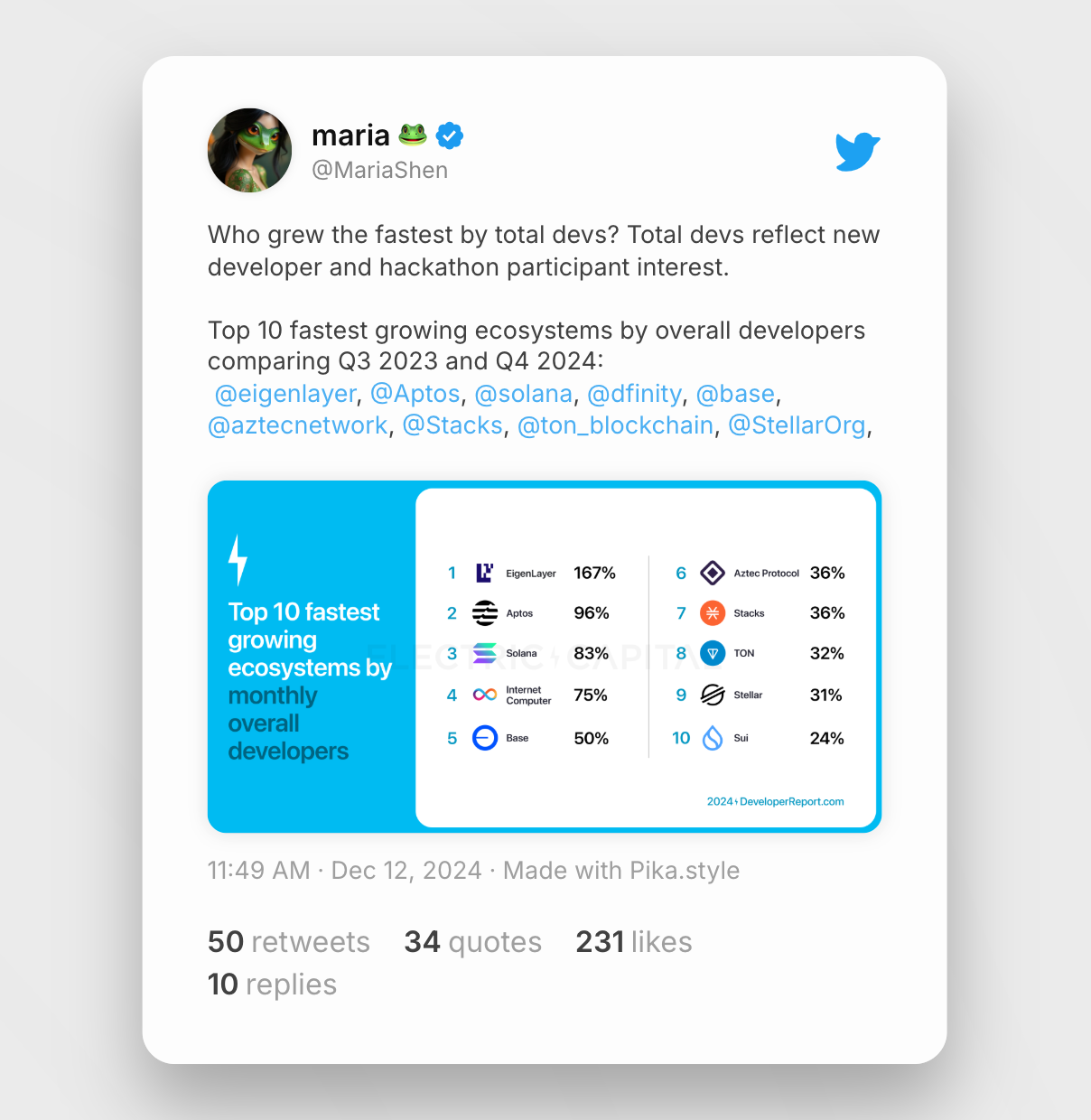

Institutional Restaking, EigenLayer Tops Aptos to Become the Fastest-Growing Ecosystem, and New AVS Launches

GM friends 👋

Welcome to this week's Re:Staking Weekly.

As we approach the end of the year, it's time for us to look back at our growth and foresee the challenges waiting for us in the future. As a restaking community, we've come a long way, but it also seems we're just getting started.

Join us this week starting with a glimpse into the future of EigenFi/Restaking Fi, breaking down restaking from the perspective of institutional asset allocators. Then, we'll rewind and celebrate our achievements, including a few new AVS announcement and EigenLayer becoming the fastest-growing ecosystem in all of Web3, surpassing Aptos, Solana, and Base.

We have a packed array of commentary and news ready for you - let's go!

Restaking, an Institutional Perspective

Over the past year, restaking news has largely centered on service onboarding and new feature releases. We've made remarkable progress in the space - nearly $20 billion in value (or 3.5% of circulating ETH) now sits delegated to operators and services. But the holy grail still seems far -- getting restaking incorporated into institutional asset allocators' frameworks. Only then can we continue to grow the overall adoption ratio and drive service onboarding.

So what's the path to put restaking onto every institutional allocator's radar?

The tricky thing about restaking is that unlike common perception, it's not a single asset class like its close sibling, staking. Instead, it presents a rather complex yield matrix.

With the nuances of the infrastructure (such as AVS sectors, general and unique stake, work payments, and operator delegation), restaking represents drastic risk and reward profiles when tweaking the parameters.

On one end, the introduction of general (non-slashable) stake lets asset allocators access essentially risk-free yield. On the other end, restaking into non-TGE (token generation event) projects represents venture-style bets, shaped by the ecosystem's airdrop history.

To increase institutional adoption, compartmentalizing these risk factors into classes of financial assets is a must. Liquid Restaking Tokens (LRTs) have shown us this is a viable approach, but their all-in-one approach needs to be further broken down to fit different allocation preferences. To kick things off and share some ideas, let me break down restaking allocation into 3 groups based on risk buckets:

The New Staking: Only putting your assets in general stake (non-slashable) to boost your ETH staking yield by a few percentage points with no added risk. If you have staked ETH or use liquid staking services, this is a no-brainer. Services still value non-slashable stake because it increases the barrier against sybil attacks (you need more capital to gain majority control).

The Better Launchpad: The current predominant strategy, where restakers deploy capital into pre-TGE + low rewards projects hoping to get airdrops. If the stake is mostly in general stake, it's not really a wild gamble. This strategy resembles a venture deal with the caveat that the principal is opportunity cost instead of actual capital expenditure.

The Crypto Bond: Perhaps the most intriguing development. Your principal faces genuine downside risk - validators can lose funds for protocol violations, much like bondholders face losses in corporate defaults. With the separation of unique and general stake, the slashable, unique stake becomes significantly more valuable. This could potentially lead to real, meaningful yield from this bucket, but obviously requires extensive service-to-service research to make the appropriate decision.

There are many more ways to formalize restaking into institutional instruments (for example, a sector-based restaking strategy), and I think this represents one of the most exciting challenges for the restaking space in the next year. What are your thoughts?

Read more:

Restaking and the price of trust - LidoDAO & Stakehouse Financial

Anchorage Digital introduce EigenLayer restaking integration

News Bites

EigenLayer is the fastest growing ecosystem over the past year, from Electric Capital.

Gasp.xyz launched its first EigenLayer integrated decentralized exchange.

Nuffle is launching its cross-chain EigenLayer restaking service soon.

Omni Network (intent-based cross-chain AVS) launches mainnet.

Sreeram (EigenLayer founder) says AI is among one of the most important objectives for EigenLayer in 2025. You should check out AI Agent Pitch Days event from Nader (EigenLayer DevRel).

EigenExplorer launches EigenLayer restaking events API.

Food for Thought

With more than 100 services actively developing on top of the restaking mechanism, we should be able to witness a significant change in market dynamics as more projects start to launch their tokens and main products in 2025.

The question, however, remains whether projects will continue to adopt restaking after it matures and whether the maturity of the projects correlates to revenue growth for restakers.

How will EigenLayer and the restaking ecosystem overcome the user adoption challenge and find a path for restaked services to gain traction? Will we see user-facing applications (such as vertical integrators like HyperLiquid) adopt restaking?

That's it for this week's newsletter! As always, feel free to send us a DM or comment directly below with your thoughts or questions.

If you want to catch up with the latest news in the restaking world, give our curated X list a follow!

See you next week and thanks for reading,