Re:Staking Weekly #3

All about slashing

GM friends 👋 and happy Thanksgiving!

Welcome to this week’s Re:Staking Weekly.

Before we know it, we're close to the final month of the year and are actually seeing the detailed plans for slashing features from EigenLayer. What a relief!

For those who are not quite up to speed, slashing is the most important feature we have anticipated since the beginning of the restaking paradigm. The term "economic security" doesn't just mean locking up value – that's only half of the picture. You also have to enforce punishment if something goes wrong, and that's where slashing comes in: confiscating locked tokens if your chosen operator misbehaves.

Although there are no official announcements from EigenLayer yet, we have pieced together a rough slashing implementation roadmap from the news of the past week. Let's dive in!

Slashing Bonanza

Slashing calculations are executed via ZK

Let’s start with the announced integration between EigenLayer and Boundless by RISC Zero, a prominent zero-knowledge proof system project.

Despite its marketing flair and many people messaging me saying they don't understand the integration, this is actually an important implementation detail that makes slashing possible.

The current EigenLayer restaking smart contracts are set up so that the designated stake from different restakers and operators is only kept in event logs. This means it's impossible to get the total restaked assets for a restaker at the moment you make the query. You have to trace back to the origin of the contract and add up the individual add or remove stake operations! And to do that for thousands of restakers and operators would be incredibly expensive (RISC Zero estimated it would cost 50,000,000 gas for a single call).

What this integration does is handle all of these actions off-chain via zk-proofs. This will make the slashing feature effectively costless — a must-have feature if we want to ensure an efficient restaking market.

To read more:

Livestream between Sreeram (EigenLayer) and Jeremy (RISC Zero)

RISC Zero’s blog post on this integration

Slashing will be on Testnet by the end of 2024

According to the operator group meeting conducted by EigenLayer, slashing is scheduled to roll out on Testnet next month.

If you've read our previous newsletters, you'll know that slashing isn't just simply confiscating users' stake deposits. To implement slashing, the first planned iteration will introduce 2 major features:

Services will be able to define specific reward and slashing logic for different groups of operators. Operator allocations and total stake will proportionally decrease with the underlying stake slashed.

Operators will be able to allocate unique and general stake to services. This is the implementation version for the new operator set feature.

After the feature release, we'll be looking at more robust and flexible options for the entire slashing workflow, such as custom burn mechanisms.

To track engineering implementations of slashing, one great source is the eigenlayer-contracts repo, specifically if you filter the slashing branches (Thanks @bcmakes for the info!).

News Bites

K3 AVS’ chic dashboard: Nader (from EigenLayer) demonstrates how to use K3 AVS to create Zapier-like on-chain and off-chain workflows. Nice product!

3 types of AVS architectures: Yashi (Othentic) breaks down 3 macro AVS design patterns.

Renzo (LRT) starts to selectively include and exclude AVS: The EigenFi competitive edge is shifting from inclusion to selection

The key to restaking is establishing an efficient risk and reward pricing: from Cap Stablecoin’s Benjamin.

Official EigenLayer governance plan (part 1): The bold and ambitious governance council design. Will this change how we govern in web3?

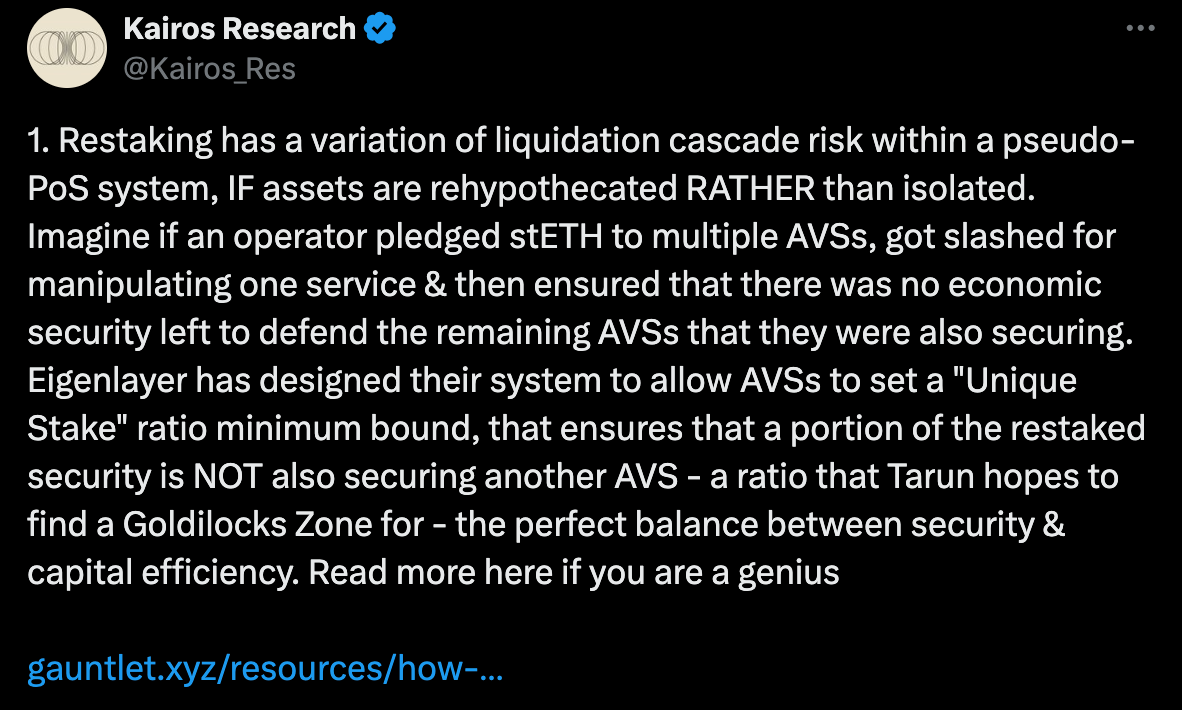

Recap on the Rollup’s interview with Gauntlet’s Tarun: what you need to know about liquid cascade risk in restaking.

Restaking in Numbers

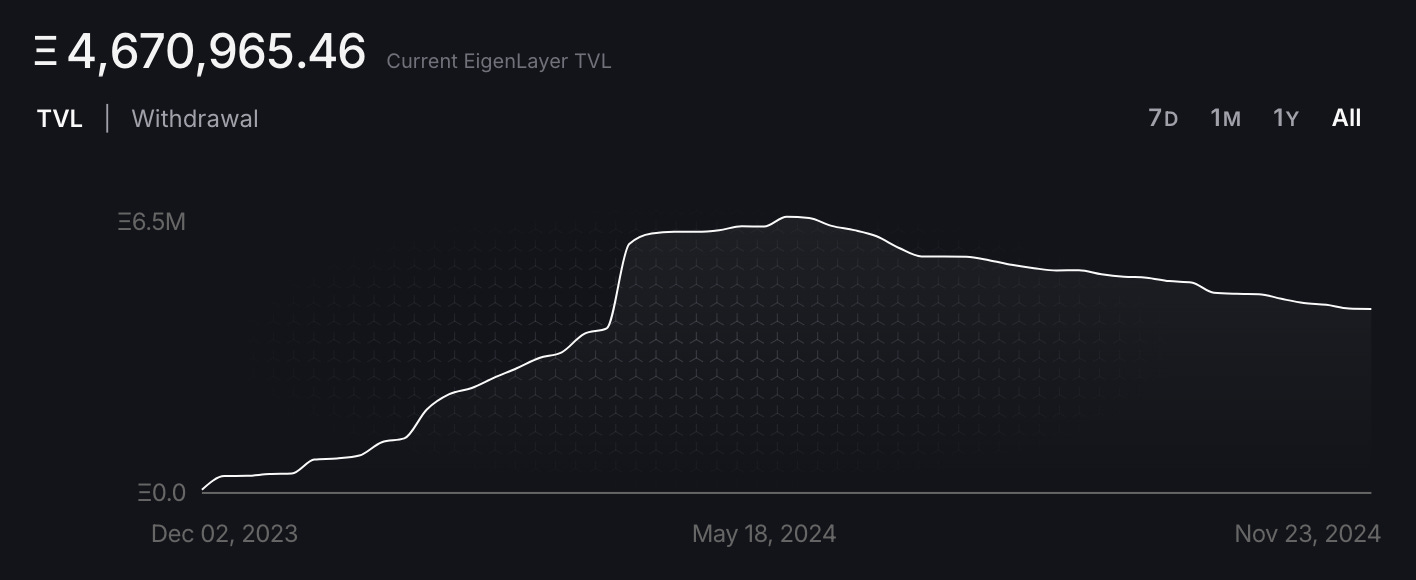

To close out this week's newsletter: ETH TVL's net outflow seems to have flattened out with just a 2.4% decrease from last week. Thanks to the booming market, however, the USD value of the TVL has actually reached an impressive $15.5 billion!

More importantly, the deployment rate has increased by 2.2%, bringing the total deployment rate of the restaked capital to almost 97%. With all of the capital deployed to operators, the market is anticipating large amounts of airdrop opportunities, as the current services giving out rewards remain at 2.

Food for Thought

Q (Liam, Re:Staking Weekly): How do AVS services handle fault checking for operators? Are they using external watchtowers/checker nodes?

A (Brandon Curtis, Director of Research, Eigen Labs): An AVS that uses the disperser/aggregator model (like EigenDA) can introspect the aggregated signatures to manage liveness. The version in production uses retrospectively verifiable enforcement of an SLA with manual operator ejection. In the future, there is a path to make this model programmatically objective and permissionless.

Fault monitoring and attestation - often overlooked but crucial - plays a key role in operator ejection and stake slashing.

A major challenge for restakers and researchers is navigating the diverse slashing conditions (e.g. deliver 10 apples or I take your deposit) and result aggregation models (e.g. how are these apples delivered and quality checked?) across different AVS operator quorums.

These rules can vary wildly between services, and without a robust monitoring framework or service, slashing simply won’t work.

That’s it for this week’s slashing feast. I’m really excited to see what’s going to happen in the next month and Q1 2025. How about you?

See you next week!

Thanks for reading,