Re:Staking Weekly #28

EigenLayer-Powered Apps Dashboard, Lagrange Unveils its Native Token $LA, zkTLS Deep Dive, and Why MegaETH’s Throughput Breakthrough Depends on EigenDA

Welcome to Issue #28 of Re:Staking Weekly! 👋

This week, we're taking a closer look at EigenLayer’s evolving app strategy — what it means, why it matters in the broader push to become an AWS-like platform with real network effects, and whether the timing is right.

Also in this issue:

EigenLayer-powered Apps Dashboard

Lagrange unveils its native token, $LA

zkTLS deep dive with insights from Jordan

Why MegaETH’s throughput breakthrough depends on EigenDA

… and more

Let’s dive in! 🚀

EigenLayer is Becoming a Platform

Over the course of its development, EigenLayer has undergone several narrative shifts — each reflecting a broader ambition.

It began with Actively Validated Services (AVSs), a new class of off-chain applications secured by Ethereum restakers. Then came the framing of EigenLayer as the verifiable infrastructure layer for AI, positioning restaking as a trust foundation for machine intelligence. Later, AVSs were rebranded to Autonomously Verifiable Services, aligning with a broader push to define EigenLayer as the verifiable cloud.

Now, a new chapter is taking shape: EigenLayer-powered applications.

In a recent talk in Dubai, EigenLayer’s founder Sreeram compared the protocol directly to AWS. While AWS comparisons have surfaced before, this time, it felt more like a deliberate declaration: EigenLayer wants to become a platform.

It’s a great ambition. But the question now is: can EigenLayer pull it off and is the timing right?

From Infrastructure to Platform

Every crypto infrastructure wants to be a platform — it’s why nearly every protocol website has an "ecosystem" section. But most confuse surface-level integrations with true platform dynamics. They count the number of apps, but don’t ask whether those apps bring net new usage.

This is the core divide between infrastructure and platforms:

A platform creates network effects — where more usage attracts more developers, which attracts more usage, and so on. It becomes the default environment to build in.

Most crypto infra never gets there. Instead, they fall into a loop of stacking more infrastructure on top of infrastructure. These secondary layers rarely onboard new users. They serve developers, not demand. As a result, the ecosystem grows sideways, not upward.

EigenLayer is at risk of falling into the same trap. It has successfully grown the number of AVSs — but most of them are themselves infrastructure, and early-stage at that. The stack is dense, but not yet activated.

The recent push toward EigenLayer-powered applications is an attempt to break that cycle. It’s a deliberate shift from simply enabling infra to orchestrating usage — to building a flywheel where apps drive activity, which drives AVS demand, which reinforces EigenLayer as the core coordination layer.

It’s a smart move and necessary move — if it works.

What’s EigenLayer’s Edge?

In Acquired’s episode on AWS, hosts Ben and David broke down what made AWS dominant. Their key points:

First-mover advantage: AWS was the first to productize infrastructure at scale.

Dogfooding: Amazon itself ran on AWS, validating it as production-grade.

Favorable macro trend: Post–dot-com startups needed backend infra but couldn’t afford to build it themselves.

Developer-first design: Modular, API-first services like S3 made AWS easy to adopt.

Customer obsession: Long-term focus on utility and scale, even at the cost of short-term revenue.

Interestingly, EigenLayer mirrors much of this.

It was the first to coin and define restaking, setting the narrative for a new layer of crypto-economic security. It built EigenDA as its native AVS, demonstrating the protocol’s capabilities — a kind of “dogfooding” in crypto terms. And it benefits from a macroeconomic shift: the diminishing centrality of L1 blockchains and the rise of modular, utility-focused, cross-chain applications.

EigenLayer is also early in its developer-centric approach, offering open architecture and modular design that lowers the barrier to integration. The emergence of AVS-as-a-Service companies like Othentic and Layer further accelerates this effort, providing developer-friendly tooling for building on EigenLayer. Compared to many crypto infrastructure projects, EigenLayer is notably more customer-focused, actively supporting AVS onboarding, providing ecosystem guidance, and taking a long-term view on utility rather than short-term metrics.

But there’s a key difference: AWS was built on physical infrastructure — servers, networking, data centers — a capital-intensive foundation that created defensibility and technical depth. EigenLayer’s foundation is soft economic power: restaked ETH and LST capital that secures AVSs.

That difference matters. The economic base of EigenLayer is mobile. Restaked capital can migrate. AVSs can adopt multiple restaking protocols. The switching costs are low. And unlike physical servers, TVL isn’t sticky — it’s reflexive, often chasing yield rather than long-term alignment.

That’s the core challenge. EigenLayer’s edge lies in the soft power such as first-mover status, developer trust, and ecosystem coordination — not deep technical lock-in. And as other restaking protocols become bigger and more competitive (e.g., Symbiotic, Babylon), EigenLayer must win on building network effects and flywheel.

Apps on EigenLayer: A Premature Push or a Strategic Moat?

The app thesis makes a lot of sense on paper:

AVSs need real usage to become sticky and profitable.

Restakers need real slashing risk to justify their economic trust.

EigenLayer needs real value flows to justify its existence.

More applications → more valuable AVSs → more aligned rewards for restakers — all reinforcing EigenLayer’s central role in the stack.

But there’s a tension. Most AVSs are still in their infancy. Tooling is immature, documentation is sparse, and many haven’t launched publicly. Yet, EigenLayer is already leaning hard into applications — encouraging developers to treat AVSs as foundational components.

It’s a bold move, but is it premature? At worst, it risks becoming a money pit: high BD overhead, low return, more confusion in the community, and EigenLayer acting as the unofficial marketing arm for early-stage infra.

Still, the push may be necessary and uniquely timed. EigenLayer is likely the only player positioned to do this effectively today — with capital, visibility, and a growing bench of AVSs that are just mature enough to support meaningful integrations. In many ways, it mirrors AWS’s early “dogfooding” strategy: seeding internal usage with long-term capital investment to catalyze external adoption.

If EigenLayer can generate enough credibility and momentum around this emerging app layer — and help AVSs land real application use cases — it could trigger a compounding loop of ecosystem gravity: where AVSs and apps choose EigenLayer not because they must, but because they know it’s where the support, trust, and traction live.

Protocol News

Latest updates on restaking protocol developments across the Ethereum, Bitcoin, and Solana ecosystems

Explore Symbiotic and Tokensight’s research into how much economic security is optimal for a restaked network.

EigenLayer’s new piece on AVS archetypes breaks down common design patterns for verifiable services, a worthwhile read for any developer building in the ecosystem.

Tuning in to Kairos Research and SatLayer’s discussion on Bitcoin restaking opportunities within the SatLayer ecosystem.

Resolvers are a core component of Symbiotic’s slashing design, echoing the earlier slashing committee model from EigenLayer. Read more about their architecture and design implications.

Watch Robert Drost, Executive Director of the Eigen Foundation, discuss the ethos behind verifiable compute and its role in the future of decentralized infrastructure.

EigenLayer has shipped its Apps Dashboard, marking a bold step toward platform status by showcasing applications built atop its AVS ecosystem.

Learn more about Symbiotic’s new narrative: universal staking.

AVS & Restaking Ecosystem

News on the latest AVS partnerships, feature releases, and innovations in the restaking ecosystem

Jordan dives deep into zkTLS and explains why it could become critical infrastructure for crypto adoption and emerging use cases.

ReTix launches as a secondary ticket marketplace built on Reclaim’s zkTLS, secured by EigenLayer and settled on Base.

Lagrange is introducing its native token, $LA, as part of its next phase of network growth.

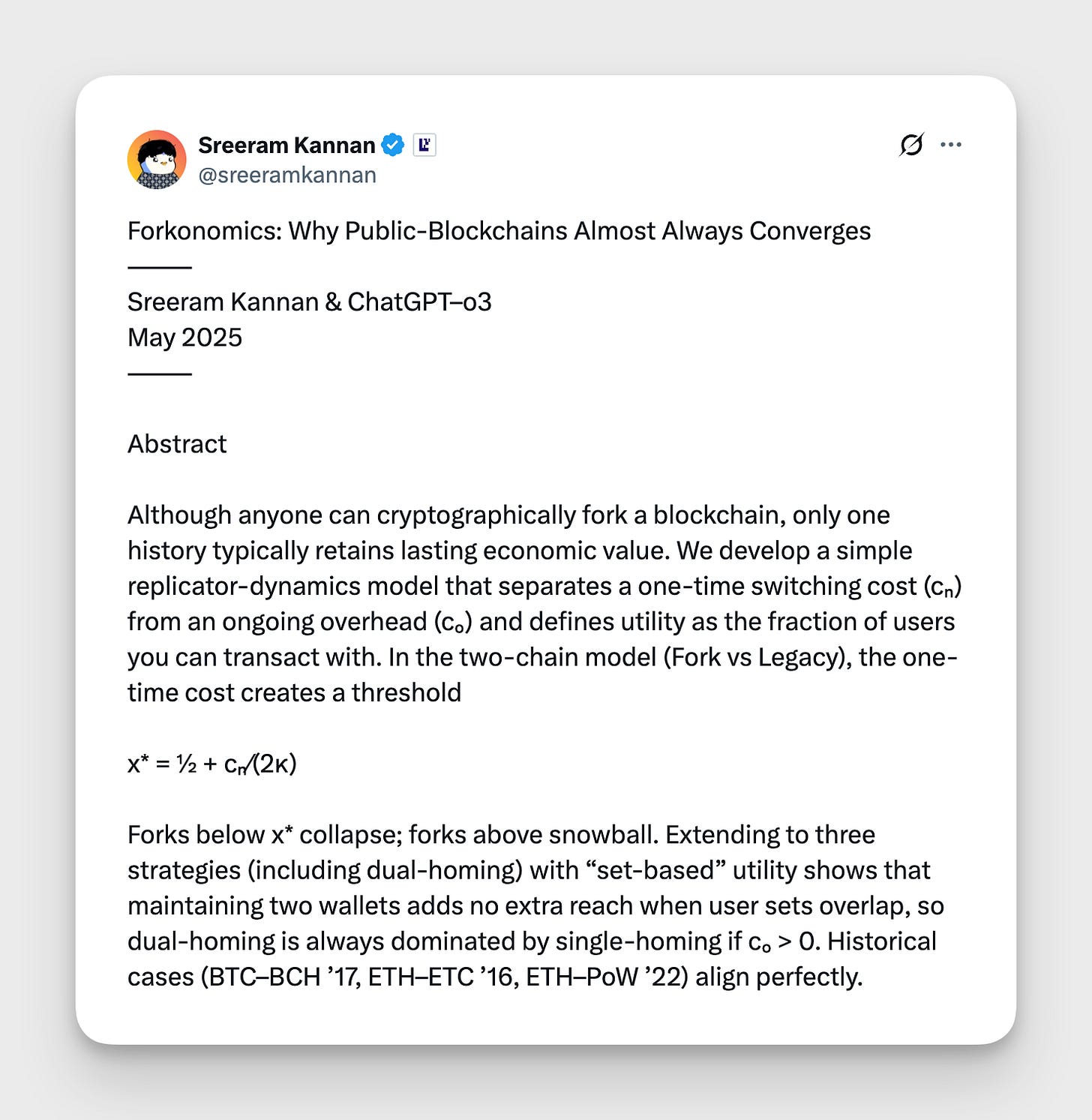

Read the industry-wide conversation sparked by EigenLayer founder Sreeram on the forkability of crypto protocols and what it means for governance, credibility, and value capture.

Built on Opacity, Daisy has crossed $1M in revenue in just 7 months — a strong signal for the future of the creator economy on verifiable infrastructure.

Aethir launches pre-deposit vaults to enable ATH restaking on EigenLayer.

Plume is joining Skate’s shared liquidity AMM as part of its expanding ecosystem of supported chains.

Read why MegaETH’s breakthrough in throughput relies on EigenDA for scalable, verifiable data availability.

Explore how Ava Protocol is building a verifiable agent platform on top of EigenLayer’s AVS framework, leveraging shared security to power trustless agent coordination.

Sooho, a core infra partner in the Bank of Korea’s CBDC pilot, is launching an AVS with Othentic to track contributions and transparently distribute incentives.

Hyperlane unveils $HYPER, a natively multichain token built for seamless interoperability.

How far can you loop LRT strategies before the risks outweigh the rewards? Dive into this research report featuring a Monte Carlo simulation that explores exactly that.

That's it for this week's newsletter! As always, feel free to send us a DM or comment directly below with your thoughts or questions.

If you want to catch up with the latest news in the restaking world, give our curated X list a follow!

See you next week and thanks for reading,