Re:Staking Weekly #24

5 AVSs Confirm Slashing and Rewards by End of Q2, Aligned Builds zk Verification Layer on EigenLayer, and Symbiotic Closes $29M Series A

Welcome to Issue #24 of Re:Staking Weekly! 👋

This week, we caught up with Luke from EigenLayer and got confirmation on some exciting news: five AVSs are set to enable slashing and rewards by the end of Q2. Things are really starting to heat up.

We’re also dropping a new episode of the Re:Staking Podcast, featuring Boris from Aligned, where we dive into how they’re leveraging EigenLayer’s verifiable service architecture to build the zk verification layer for Ethereum — cutting proof verification costs by 90%. This tackles one of the biggest bottlenecks for zk adoption to date.

Also in this issue:

Symbiotic’s $29M Series A

EtherFi’s move into cash services and neobank expansion

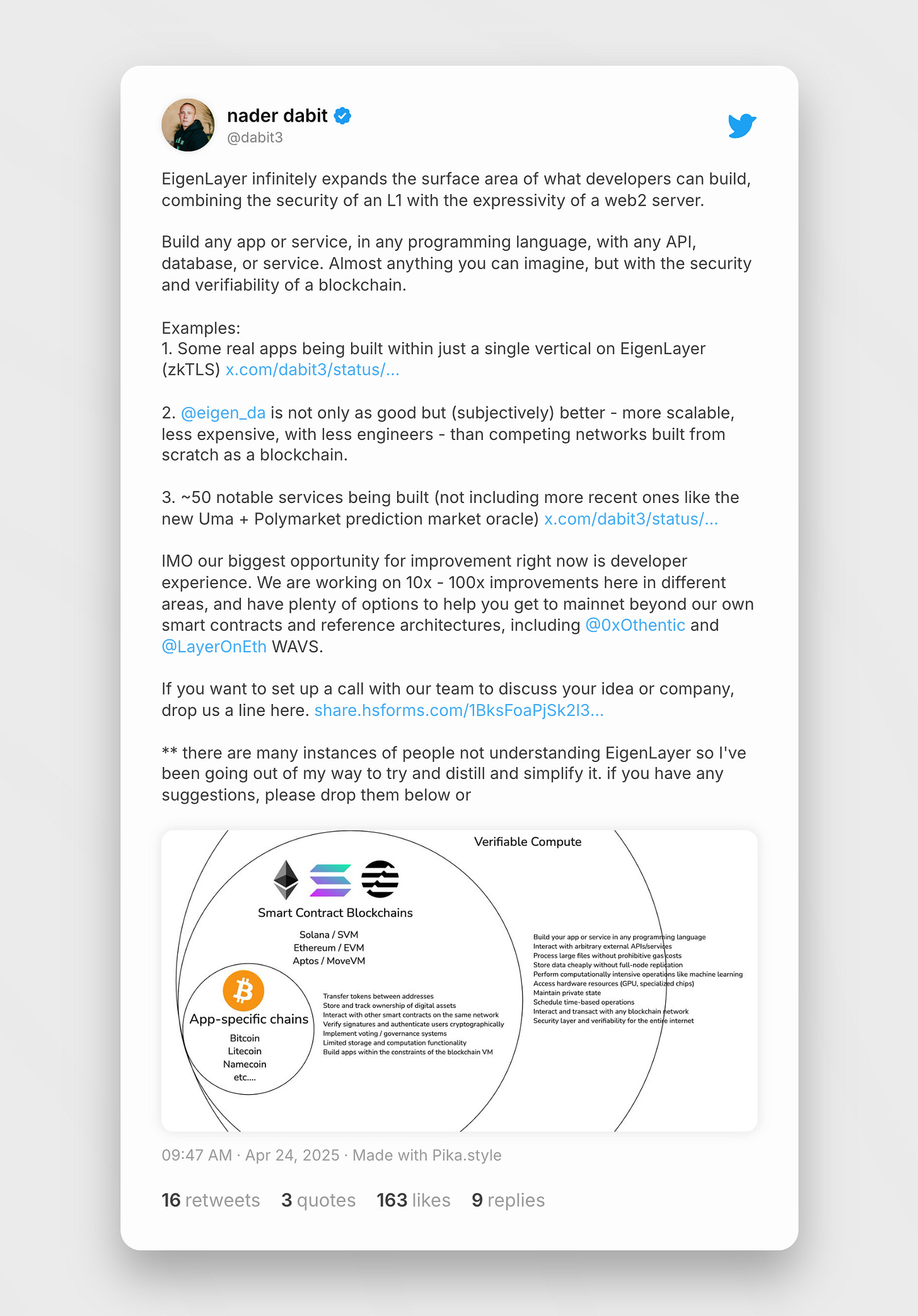

Nader’s latest thoughts on the future of verifiable services

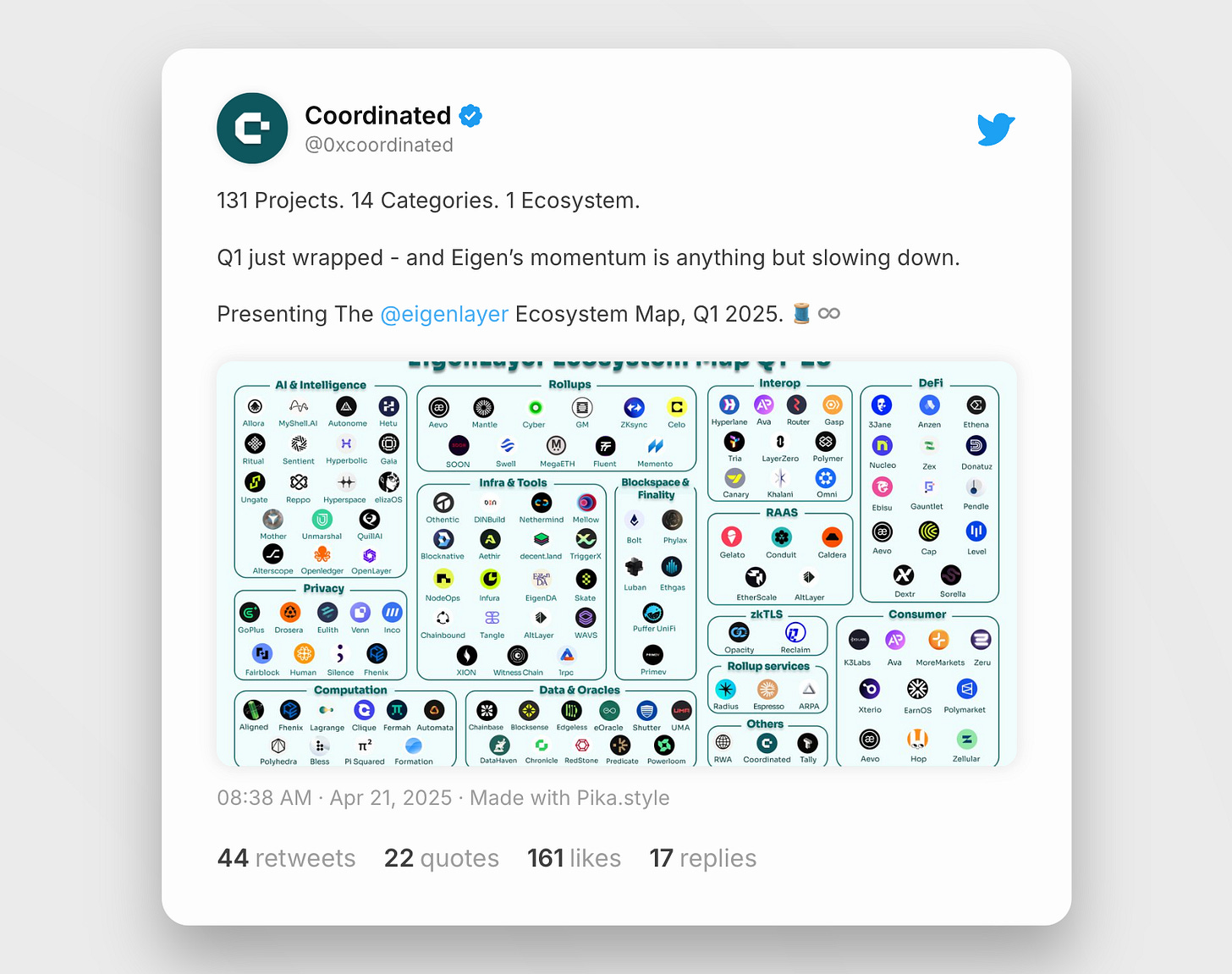

EigenLayer’s new ecosystem map

… and more.

Let’s go! 🚀

5 AVS to Adopt Slashing in Q2

Immediately after the slashing feature’s mainnet release — and once the initial excitement fades — the real question becomes: which AVSs will actually adopt slashing, and when?

According to Luke, Head of AVS Business Development at EigenLabs, we should expect at least five AVSs to implement slashing and begin issuing rewards before the end of Q2 — within the next two months. This marks an important transition from slashing as a theoretical mechanism to slashing as a live, enforceable system that secures real services.

Among the first wave, Infura’s Decentralized Infrastructure Network (DIN) and LayerZero are confirmed to be part of the lineup. Both are well-known names with significant infrastructure footprints, and their participation could set the tone for broader AVS adoption.

As slashing moves from roadmap to reality, the coming months will make clear which AVSs are truly serious about economic security — and which are not. More importantly, this also marks a turning point for restaking yields. With slashing in place, rewards will be better aligned with real work and real risk — and I’m sure the market will appreciate seeing some hard-earned returns on their restaked assets.

The Proof Verification Layer for Ethereum with Aligned

Aligned is addressing one of the biggest bottlenecks in Ethereum’s scaling roadmap: proof verification cost.

While zero-knowledge proofs (ZKPs) have unlocked powerful new possibilities for scaling, privacy, and trust minimization, verifying those proofs directly on Ethereum remains prohibitively expensive. Aligned tackles this challenge head-on as an Autonomous Verifiable Service (AVS) within EigenLayer — making proof verification cheaper, faster, and massively scalable.

The mission is simple but critical: accelerate the adoption of ZK and Ethereum by making proof verification economically viable.

1. Moving Proof Verification to a Verifiable Service

The point of a verifiable service is to make trust-minimized computation either cheaper, faster — or both.

That’s exactly the core of Aligned’s model. It provides the missing middleware for the ZK stack: a decentralized network of operators that verifies proofs off-chain, signs the results with BLS signatures, and posts aggregated attestations back to Ethereum.

This design reduces verification gas costs by up to 90% while preserving the on-chain guarantees developers depend on.

2. Economic Security Borrowed from Ethereum via EigenLayer

Aligned wouldn’t exist without EigenLayer. As an AVS, it leverages EigenLayer’s restaked ETH to secure its network of proof verification operators.

With over 2.7 million ETH restaked and 56 active operators, Aligned ranks among the largest AVSs by total value secured. EigenLayer’s economic security ensures that operators are properly incentivized to verify proofs honestly and at scale.

3. Enabling New ZK Use Cases Once Considered Impossible

The high cost of on-chain verification has long been the gating factor for many ZK-based applications — including trustless bridges, identity systems, and ZK machine learning.

By dramatically reducing these costs, Aligned unlocks use cases that were previously out of reach. A real-world example: Aligned powers the first-ever trustless Mina-to-Ethereum bridge, verifying Mina’s “Kimchi” proofs that would otherwise be too expensive to validate directly on Ethereum.

4. PMF & Revenue Model

One of the strongest signals that Aligned is on the right track? They’re their own first customer.

Aligned was born out of necessity. Its parent company — Lambda Class, a venture studio and deep tech engineering firm based in Argentina — wanted to build products that relied on zero-knowledge proofs. But the cost of on-chain proof verification made many of those ideas economically impossible. The solution? Build the missing piece of infrastructure themselves.

Aligned’s core customer is the developer — the builders of ZK-powered apps, rollups, and protocols. Its subscription-based revenue model allows these projects to stake Align tokens for access to verification services, with operators paid in Align or ETH. A dual staking mechanism and slashing protections via EigenLayer are on the roadmap to reinforce security and long-term alignment.

“We like to say we’re like a microservice for Ethereum — optimized for a specific task, but secured by Ethereum’s economic guarantees.”

Many verifiable services aren’t like the shiny new L1s that chase attention and headlines — and that’s what I like about them. They’re focused on building honest, functional businesses with real utility and staying power.

For Aligned, the bet is clear: a future where zero-knowledge-based verification quietly powers nearly every application we use. And that future feels closer than most people expect.

Learn More

News Bites

Symbiotic’s $29 million Series A financing, led by Pantera Capital, marks a significant milestone for the restaking sector and highlights the direction in which the industry is moving.

With its EigenLayer integration, Kite AI unlocks decentralized validation for AI assets and inference results — secured by its distributed operator network.

Check out Pratik’s article on zkTLS and why it is becoming a key vertical for our space.

Nader expands on the evolving Web3 infrastructure stack and discusses how the verifiable compute paradigm could drive greater developer adoption.

EigenLayer is giving out $2.5k for great ideas — submit yours to the Verifiable App Awards!

EtherFi, a leading LRT protocol, just unveiled its card business, marking its first step toward a neobank model — and potentially driving more assets into restaking yield opportunities.

Bondless (by zkSync), the partner responsible for verifying EigenLayer’s slashing transactions, has published its first whitepaper.

Curious where to restake? This ecosystem map breaks down the AVS landscape.

Verifiable services are showing up everywhere — EigenLayer AVS now powers anti-cheat engines for matches between chess grandmasters.

That's it for this week's newsletter! As always, feel free to send us a DM or comment directly below with your thoughts or questions.

If you want to catch up with the latest news in the restaking world, give our curated X list a follow!

See you next week and thanks for reading,